ACH Transactions

ACH (Automated Clearing House) transactions are essentially electronic fund transfers that use the ACH Network to move money from an account at one financial institution to another. Examples include direct deposits, single or recurring bill payments, and online payment transactions.

A monthly ACH Transaction is 1 of the 4 qualifying criteria for the High Yield Checking account. To earn the higher dividend, the account is required to have at least 1 ACH per month.

Examples of ACH Transactions

ACH Direct Deposit:

Direct deposit allows your employer to transfer your paycheck directly into your account, so you can use your money as soon as it’s sent. You’ll have fast, secure access to your money, AND reduce your risk of ID theft and mail fraud. To take advantage of Direct Deposit, download the Direct Deposit Form, complete the form, and provide it to your payroll or accounting department. Even better, add to the convenience with an eAlert and we will text or email you when the deposit is made into your account!

ACH Credit Transaction

An example of ACH credit payments are transactions sent via Digital Banking’s Bill Pay Service. Through Bill Pay, you authorize Midcoast FCU to credit a person or company’s account (i.e. your landlord) from your account using their account number and routing number.

ACH Debit Transaction

ACH debit transactions occur when you provide the merchant with your account number and routing number to withdraw the payment directly from your savings or checking account. The payment is processed with the merchant, in person, on the phone, or through their website, typically for monthly expenses such as mortgage, credit card, or utility bill transactions.

Where to find numbers

- Midcoast FCU routing number (211287476)

- Your ACH/MICR number, which is your unique 14-digit account number. It can be easily located at the bottom of your checks.

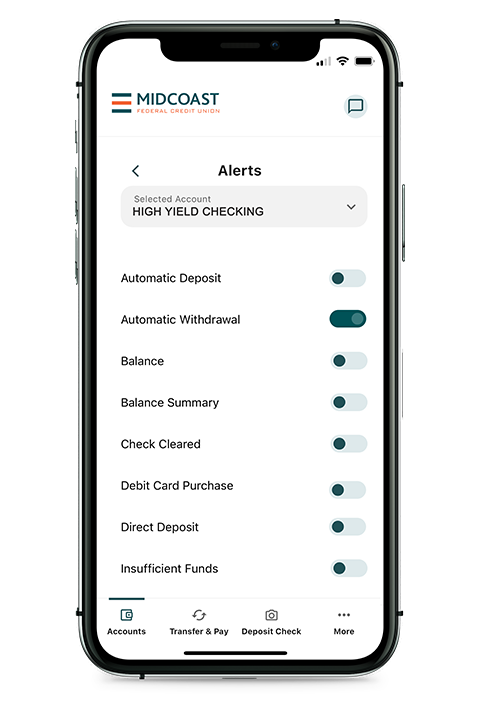

Get notified when your ACH payment has processed with eAlerts

You can add to the convenience with an eAlert and we will text or email you when an electronic withdrawal is paid from your account! Accessed via Digital Banking, eAlerts are free, customizable, easy to establish, and can be modified at any time. eAlerts can be sent via email or text/push notification and are activated on or off with the toggle of a switch.